Anti-Money Laundering (AML)

The curriculum for an Anti-Money Laundering (AML) course is comprehensive, covering various aspects of money laundering, UK legislation and regulations, anti-money laundering regulation development, the role of Money Laundering Reporting Officers (MLROs), risk-based approaches, customer due diligence, record-keeping, suspicious activities and transactions, as well as the Proceeds of Crime Act (POCA) and anti-terrorism provisions. Let’s delve into each module in detail.

What I will learn?

- Understand the fundamentals of money laundering and its global impact.

- Be well-versed in UK-specific AML laws and regulations.

- Recognize and implement effective risk-based approaches to AML.

- Conduct thorough Customer Due Diligence and Enhanced Due Diligence.

- Efficiently identify and report suspicious activities and transactions.

- Be aware of the roles and responsibilities of Money Laundering Reporting Officers.

- Maintain appropriate records in compliance with UK regulations.

- Understand the implications of the Proceeds of Crime Act and anti-terrorism provisions in the UK.

Course Curriculum

Module 1: Introduction to Money Laundering

This module introduces the concept of money laundering, exploring its definition, methods, scale, implications for businesses, and economic impact. It also addresses the estimated global volume of laundered money and the consequences of such activities. Understanding the basics of what constitutes money laundering sets the foundation for the course.

-

Introduction to Money Laundering

Module 2: UK legislation and Regulations

Focusing on the UK, this module outlines the various legislations and regulations relevant to anti-money laundering. Key acts such as the Money Laundering Regulations 2017, Criminal Finances Act 2017, Terrorist Financing Legislation, Sanctions and Anti-Money Laundering Act 2018, and the Proceeds of Crime Act 2002 are covered. This part of the curriculum emphasizes the legal framework within which UK AML activities are governed.

-

UK legislation and Regulations

Module 3: Anti-Money Laundering Regulation and Development

This module discusses the evolution of AML systems and laws, the development of the regulatory regime, the role of different government and financial entities, and international initiatives in AML. It also looks at the UK's Financial Intelligence Unit and law enforcement agencies' roles in combating money laundering.

-

Anti-Money Laundering Regulation and Development

Module 4: The Money Laundering Reporting Officer’s Responsibilities

An MLRO plays a crucial role in an organization's AML efforts. This module explains the role, responsibilities, selection process, and the importance of having an MLRO. It also touches upon the consequences of non-compliance in this role.

-

The Money Laundering Reporting Officer’s Responsibilities

Module 5: Risk-based Approach

A risk-based approach to AML is vital for effectively managing potential threats. This module covers the implementation of such an approach, including conducting risk assessments, customer risk assessment, and innovative solutions for AML.

-

Risk-based Approach

Module 6: Customer Due Diligence

Customer Due Diligence (CDD) is essential in AML efforts. This module details the CDD process, including the basics of conducting due diligence, reporting suspicious transactions, and differentiating between standard CDD and Enhanced Due Diligence (EDD).

-

Customer Due Diligence

Module 7: Record Keeping

Record-keeping is a critical part of AML compliance. This module discusses the types of records that should be maintained, such as CDD documentation, SARs, and internal AML control records. It also addresses the format and transmission of these records.

-

Record Keeping

Module 8: Suspicious Conduct and Transactions

Recognizing suspicious transactions and conduct is key in AML. This module provides examples of such activities and discusses the importance of Suspicious Activity Reports (SARs), including who can file them and how they are used.

-

Suspicious Conduct and Transactions

Module 9: POCA and Anti-terrorism provisions

Finally, this module focuses on the Proceeds of Crime Act 2002 and anti-terrorism provisions related to AML. It covers offences related to money laundering, failure to disclose, tipping off offences, and the latest developments in this area.

-

POCA and Anti-terrorism provisions

Get Your Certificate & Transcript

-

Get Your Certificate & Transcript

Certificate of Completion - Free

Add this certificate to your resume to demonstrate your skills & increase your chances of getting noticed.

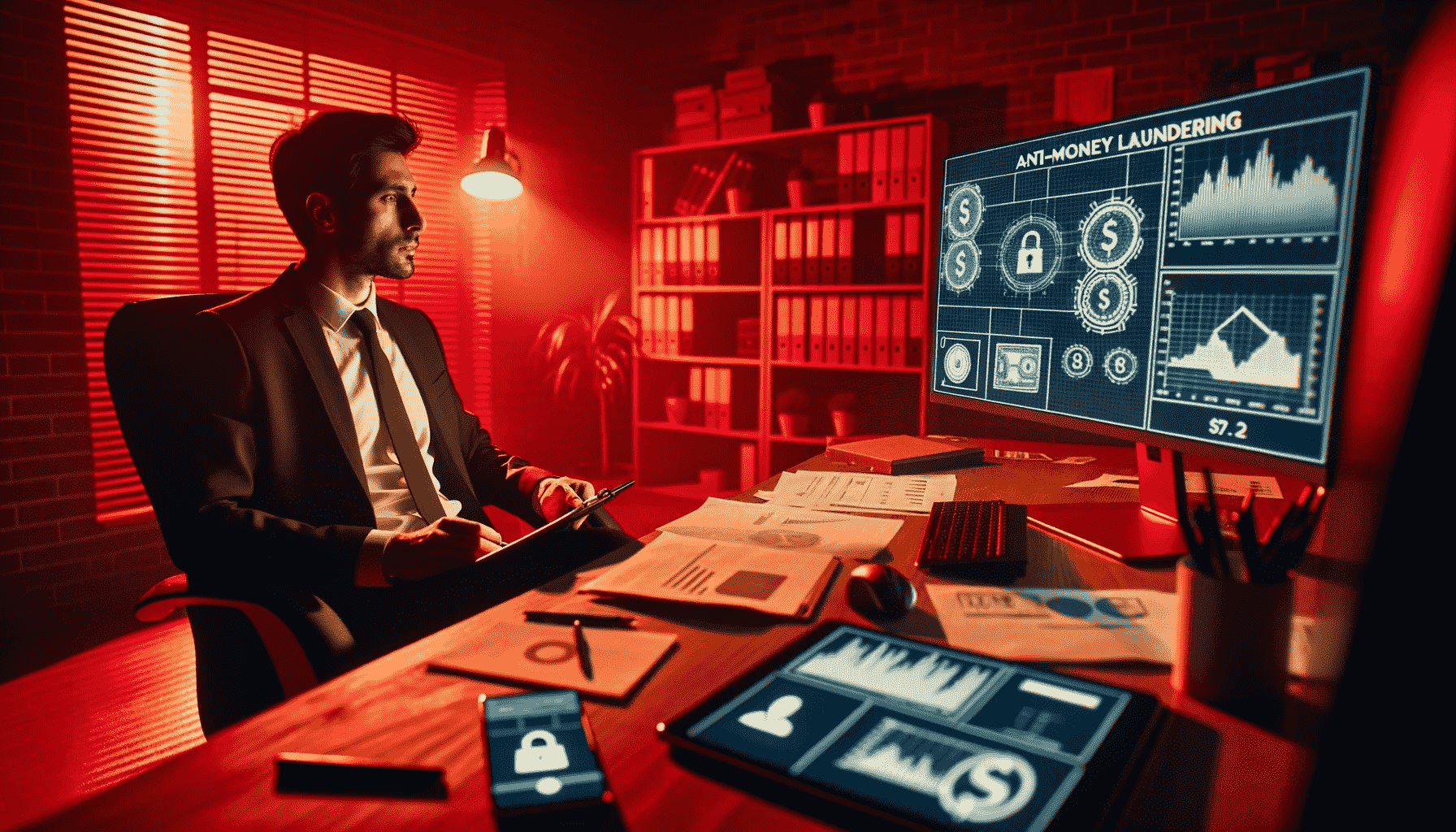

Why Choose Wisdom Learning UK's AML Course?

1. Free Student Support: Wisdom Learning UK provides unparalleled student support at no extra cost. Our dedicated team is available to assist you throughout your learning journey, ensuring a smooth and effective learning experience.

2. Free Certificate: Upon successful completion of the course, you receive a certificate of completion at no additional charge. This certificate is a testament to your knowledge and skills, enhancing your professional credibility.

3. Expertly Designed Curriculum: Our AML course is expertly crafted by industry professionals, ensuring that you receive practical, real-world knowledge. The course material is designed to be engaging and interactive, making your learning experience both informative and enjoyable.

4. UK-Specific Content: The course focuses specifically on UK regulations and legislations, making it highly relevant for those looking to operate within the UK’s financial sector. This specificity ensures that you are well-prepared to navigate the complexities of the UK’s AML framework.

5. Up-to-Date Information: The financial landscape is constantly evolving, and so is our course. We regularly update our content to reflect the latest changes in laws, regulations, and best practices. This commitment keeps you at the forefront of AML knowledge.

-

LevelAll Levels

-

Duration8 hours

-

Last UpdatedApril 30, 2024

-

Enrollment validityEnrollment validity: 365 days

-

CertificateCertificate of completion

A course by

Recommended for You

Who is This Course For?

Our AML course is ideal for a range of professionals, including:

- Financial officers and managers

- Compliance and regulatory professionals

- Legal professionals

- Accountants and auditors

- Risk management specialists

- Anyone aspiring to enhance their understanding of AML practices and regulations

Whether you’re looking to advance in your current role or seeking a new career path in the financial sector, this course offers the knowledge and credentials you need.

Career Path

- AML Compliance Officer

- Financial Crime Analyst

- Regulatory Compliance Manager

- Risk Assurance Officer

- Legal Consultant specializing in AML

- Senior Auditor in financial institutions

These roles are in high demand across the financial sector, legal firms, governmental bodies, and international corporations. With the certification from Wisdom Learning UK, you position yourself as a knowledgeable and competent professional, ready to tackle the challenges of AML compliance in the UK.

Want to receive push notifications for all major on-site activities?