Know Your Customer – KYC

Categories

Accounting and finance, Law

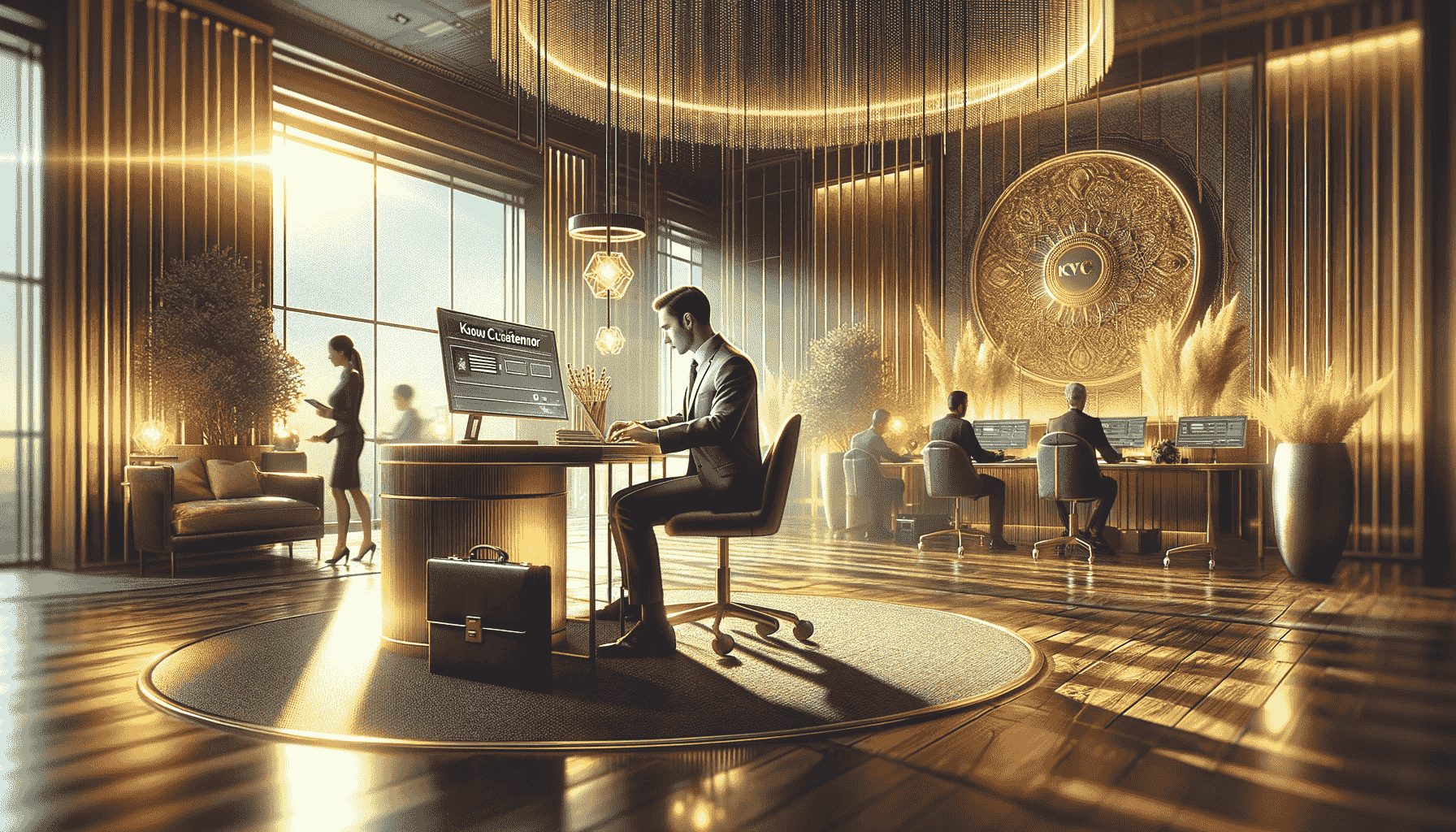

Unlock the potential of your career in finance with the comprehensive KYC Course offered by Wisdom Learning UK. This in-depth program is meticulously designed to provide finance professionals and enthusiasts with the latest insights into Know Your Customer (KYC) protocols. Our course delves into crucial topics such as customer identity verification, risk management, and adherence to global anti-money laundering (AML) standards. With a curriculum crafted by industry experts, you’ll gain valuable skills in detecting and managing financial risks, ensuring compliance with legal regulations, and implementing effective customer due diligence processes.

What I will learn?

- Comprehensive understanding of KYC, KYCC, and KYB.

- Mastery of KYC verification processes and requirements.

- Insight into UK-specific KYC and AML regulations.

- Knowledge of data privacy laws in relation to AML and KYC.

- Proficiency in implementing KYC and AML checks and procedures.

Course Curriculum

Module 1: Overview of KYC

• What is KYC?

• What is KYCC?

• What is KYB?

• Understanding Know Your Customer (KYC)

• Requirements for Know Your Customer Checklists

• What Is KYC Verification?

• What Is KYC in the Banking Sector?

• What Are KYC Documents?

• Why is KYC so important?

• Conventional KYC processes

• AML vs KYC: What's the difference?

• Who needs to have KYC processes?

-

Overview of KYC

00:00

Module 2: KYC Compliance

• What exactly does "KYC compliance" mean?

• KYC compliance process

• Who is obliged to comply with KYC regulations?

• Compliance with KYC regulations in the digital era

• The future of regulatory developments in the UK

• KYC and Customer Due Diligence measures

-

KYC Compliance

00:00

Module 3: KYC & AML Regulations in the UK

• The Prospects for Financial Crime in the United Kingdom: 2022 and Beyond

• Prominent Know-Your-Customer and Anti-Money Laundering Regulators Working in the UK

• Financial Conduct Authority (FCA)

• Her Majesty's Revenue and Customs (HMRC)

• National Crime Agency (NCA)

• What is the Current Situation?

• What are the Most Recent Guidelines?

• Why are these important?

• Why is it Important to Keep up with this information?

• What are the main money laundering regulations in the UK?

• Who regulates AML in the UK?

-

KYC & AML Regulations in the UK

00:00

Module 4: Regulations for Data Privacy AML and, KYC,

• The Data Protection Act 2018

• Data protection and AML

• Personal information and AML checks

• What problems do KYC solutions face in terms of protecting personal data?

• How can KYC systems address the current concerns of personal data protection?

• How could they comply with data privacy laws and provide a frictionless client experience

• while implementing KYC and AML?

-

Regulations for Data Privacy AML and, KYC,

00:00

Module 5: Methods to perform KYC

• What does "KYC" stand for?

• "Know Your Customer" refers to the procedures that must be followed by a company

• (or a financial institution) in order to:

• Customer Identification Program (CIP)

• Customer Due Diligence

• Ongoing monitoring

• Corporate Know Your Customers

• Individuals should be subjected to AML and KYC checks.

-

Methods to perform KYC

00:00

Module 6: Methods to perform AML

• What exactly does "Anti-Money Laundering" refer to?

• What exactly does it mean to comply with AML standards?

• Controls for the Prevention of Money Laundering

• AML basics

• Step-by-step instructions on how to create an anti-money laundering (AML) programme

• Step 2: Provide training to staff members.

• Step 3. Perform risk assessment

• Step 4: Creating internal policies and procedures

• Step 5. Detect suspicious activity and report it

• Step 6. Organise independent audits

-

Methods to perform AML

00:00

Module 7: Tendencies Regarding KYC in 2023

• The year 2023 will see the emergence of new technologies and legislation.

• The widespread use of verification methods that do not require the production of documents

• Controlling the Know Your Customer procedure

• The collaboration of Know Your Customer (KYC) and Know Your Transaction (KYT)

• Management of cryptocurrencies and digital assets

• The use of machine learning and other forms of artificial intelligence

• Applying AI to the Task of Tracking Down Money Launderers

• Training Compliance Officers with the Help of AI

• Ultimate Beneficial Ownership (UBO)

• Economic slump and fraud risk correlation

-

Tendencies Regarding KYC in 2023

00:00

£11.11

£22.00

-

LevelAll Levels

-

Duration7 hours

-

Last UpdatedDecember 13, 2023

-

Enrollment validityEnrollment validity: Lifetime

-

CertificateCertificate of completion

Hi, Welcome back!

Who is this Course for?

- Professionals in the banking and financial sectors.

- Compliance officers and legal advisors.

- Individuals aspiring to careers in financial regulation and compliance.

- Business owners seeking to understand KYC/AML requirements.

Recommended for You

« Previous

Next »

Want to receive push notifications for all major on-site activities?

✕